SusBDe has been a pioneer in sustainable waste-to-energy solutions since 2009. Specializing in transforming organic waste into compressed biogas (CBG), liquefied natural gas (LNG), and electricity, SusBDe has successfully implemented large-scale projects globally.

A notable example is the Nagpur initiative, India, where we process 1,200 metric tons of municipal solid waste daily, producing over 27 million cubic meters of CBG annually. This project exemplifies their capability to deliver environmentally beneficial and economically viable energy solutions. SusDBe and its partners have designed more than 100 plants and over 20 executed.

The synergy between SusBDe's technological process in biogas production and partnering with local expertise in project development positions them uniquely to contribute to Poland's renewable energy goals. Our local way of working will effectively address the nation's objectives of increasing the share of renewables in the energy mix, as outlined in Poland's Energy Policy for 2040. Investing in this platform is not only promises substantial returns but also supports Poland's commitment to sustainable and clean energy development.

Poland generates approximately 4.5 million tonnes of poultry and chicken litter annually, currently incurring significant disposal costs. Leveraging our proprietary biogas fermentation technology, optimized specifically for poultry manure, we possess a substantial competitive advantage by converting waste into valuable biogas and premium fertilizer.

Although our technology accommodates various feedstocks (as well cow dung and agricultural), peak operational efficiency and a maximum financial viability are achieved with poultry and chicken litter, maintaining consistent fertilizer quality. The untapped feedstock potential and our patented technology are the basis of our strategic focus on poultry and/or chickn litter based anaerobic digestion.

We have currently identified and assessed 150 potential locations suitable for developing 1 MWe biogas plants (each producing 2.5 MWg).

An Iinitial development of 3 plants, each 1 MWe, strategically positioned within a 50-70 km radius to optimize operational and maintenance efficiency.

Subsequent development of 1 larger demonstration plant (10 Mwe/25 MWg) at the most suitable site based on initial insights.

The Vision of SusBDe is to execute the Centurion Program over the next seven years.

Key outcome is based on:

This is the entry phase for this project.

A total of 4 plants, of which 3 smaller and 1 larger one.

Minimized feedstock costs, secure partnerships with key entities for reliable operations.

Our core objective is to create enduring value for our investors while establishing a leadership position in the Polish market. We're building with long-term independence in mind, but we’re also acutely aware of the strategic interest from major players, such as Shell, who have been active in acquiring companies in adjacent sectors. While an exit is not our primary goal, we’re structuring the business to maintain strategic flexibility — whether that leads to an acquisition, merger, or a public offering upon reaching scale between year 5 and 7 after commencing operations.

The initial investment is repaid by preferred dividend streams.

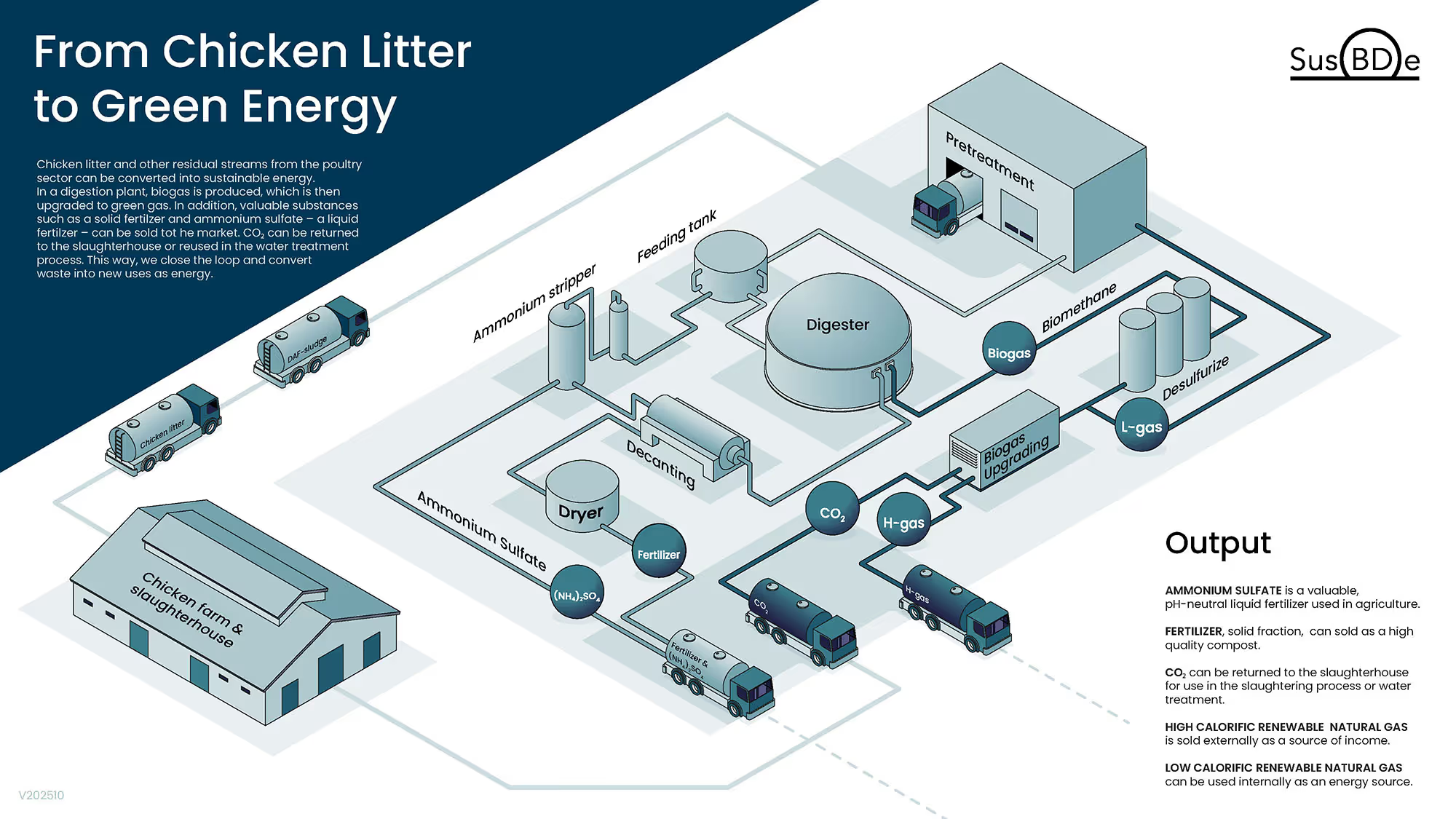

Chicken litter and other residual streams from the poultry sector can be converted into sustainable energy. In a digestion plant, biogas is produced, which is then upgraded to green gas. In addition, valuable substances such as a solid fertilzer and ammonium sulfate – a liquid fertilzer – can be sold tot he market. CO2 can be returned to the slaughterhouse or reused in the water treatment process. This way, we close the loop and convert waste into new uses as energy.

To mitigate risks and secure investor returns in the renewable energy project, The SusBDe OCIP provides a comprehensive set of guarantees structured around three key areas:

The insurance program and financial performance guarantee structures are designed to be transferable directly to investors, further enhancing financial security and investor confidence.

SusBDe has established a comprehensive insurance framework specifically designed to safeguard investor capital and interests. This robust protection strategy ensures risk mitigation across key project dimensions, significantly enhancing investment security. Coverage includes:

Coverage Duration: The insurance policy spans the entire construction period and extends through the initial ten years of project operations, providing investors with sustained confidence and financial security.

SusBDe ensures operational excellence through a long-term service agreement offering:

Duration: 10 years post-Commercial Operation Date (COD), with options to extend up to 30 years.

To safeguard investor returns tied directly to energy production, SusBDe provides a monetized performance guarantee:

Duration: Available for 5 or 10 years post-COD.

We’d love to guide the journey to achieving your business sustainability goals. SusBDe helps you find the right solution to make more out of your waste.